News & Events

Stay up to date on all our exciting new events and view past webinars and podcasts with instant playback.

AfDB approves $22.8m grant to boost rice production, climate resilience in Mozambique

The African Development Bank Group has approved a $22.8 million grant through its African Development Fund to strengthen Mozambique’s rice value chain and boost climate resilience. The Rice Value Chain and Climate Resilience Project (RIVACREP) will benefit 30,000 smallholder farmers across four provinces, focusing on empowering women and youth.

Mozambique produces only 300,000 tons of rice annually—just half of the domestic demand—resulting in heavy reliance on imports, which affects foreign reserves and perpetuates rural poverty. The AfDB-backed initiative seeks to increase rice self-sufficiency from 50% to 75% by 2030 using climate-smart technologies, public-private partnerships, and targeted interventions.

Key project measures include upgrading irrigation systems for 1,000 hectares, building five milling factories, introducing drought- and flood-resistant rice seeds, improving storage facilities, and enhancing soil and water management. About 70% of beneficiaries will be women and 30% youth.

Read the original article here: https://www.devdiscourse.com/article/business/3651069-mega-merger-global-giants-eye-aligned-data-centers-in-40-billion-deal

Mines ministry’s KABIL in talks with Zambia, other countries for acquisitions

Khanij Bidesh India Limited (KABIL), a joint venture under the Ministry of Mines, is expanding its international footprint by pursuing mineral assets in Zambia and Chile, announced Union Minister for Coal and Mines G Kishan Reddy.

Speaking at the 6th Critical Minerals Blocks Auction Launch, Reddy highlighted India’s commitment to securing critical minerals, noting the government’s USD 4 billion allocation for the National Critical Mineral Mission – four times larger than similar U.S. investments.

KABIL has already secured lithium blocks in Argentina and is actively pursuing partnerships with Japan, Peru, Australia, and the UAE. This expansion aligns with India’s strategy to meet the projected threefold increase in global demand for EV batteries and renewable energy by 2030.

Read the original article here: https://www.outlookbusiness.com/economy-and-policy/critical-minerals-mines-ministrys-kabil-in-talks-with-zambia-other-countries-for-acquisitions

Smriti Mandhana shatters Virat Kohli’s record to score fastest century in ODI for India

Indian cricket sensation Smriti Mandhana has etched her name in history by scoring the fastest ODI century by an Indian, surpassing cricket legend Virat Kohli’s previous record. Mandhana reached her hundred in just 50 balls during a match against Australia, eclipsing Kohli’s 53-ball century against the same opposition in 2013.

The explosive innings also marks the second-fastest century in women’s cricket history, falling just short of Meg Lanning’s 45-ball record set against New Zealand in 2012. This remarkable achievement adds to Mandhana’s impressive career statistics, bringing her ODI century count to 13. She now stands within striking distance of Lanning’s all-time women’s record of 15 centuries.

Read the original article here: https://www.connectedtoindia.com/smriti-mandhana-shatters-virat-kohlis-record-to-score-fastest-century-in-odi-for-india/#google_vignette

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Fireside Chat: A Surgeon’s Mission in Rwanda

We are delighted to welcome Mr. James Han Boon KONG for an insightful fireside chat conversation on his recent medical mission experience with Global Clinic in Butare, Rwanda. As an esteemed British surgeon with over 40 years of experience, Mr. KONG volunteered his...

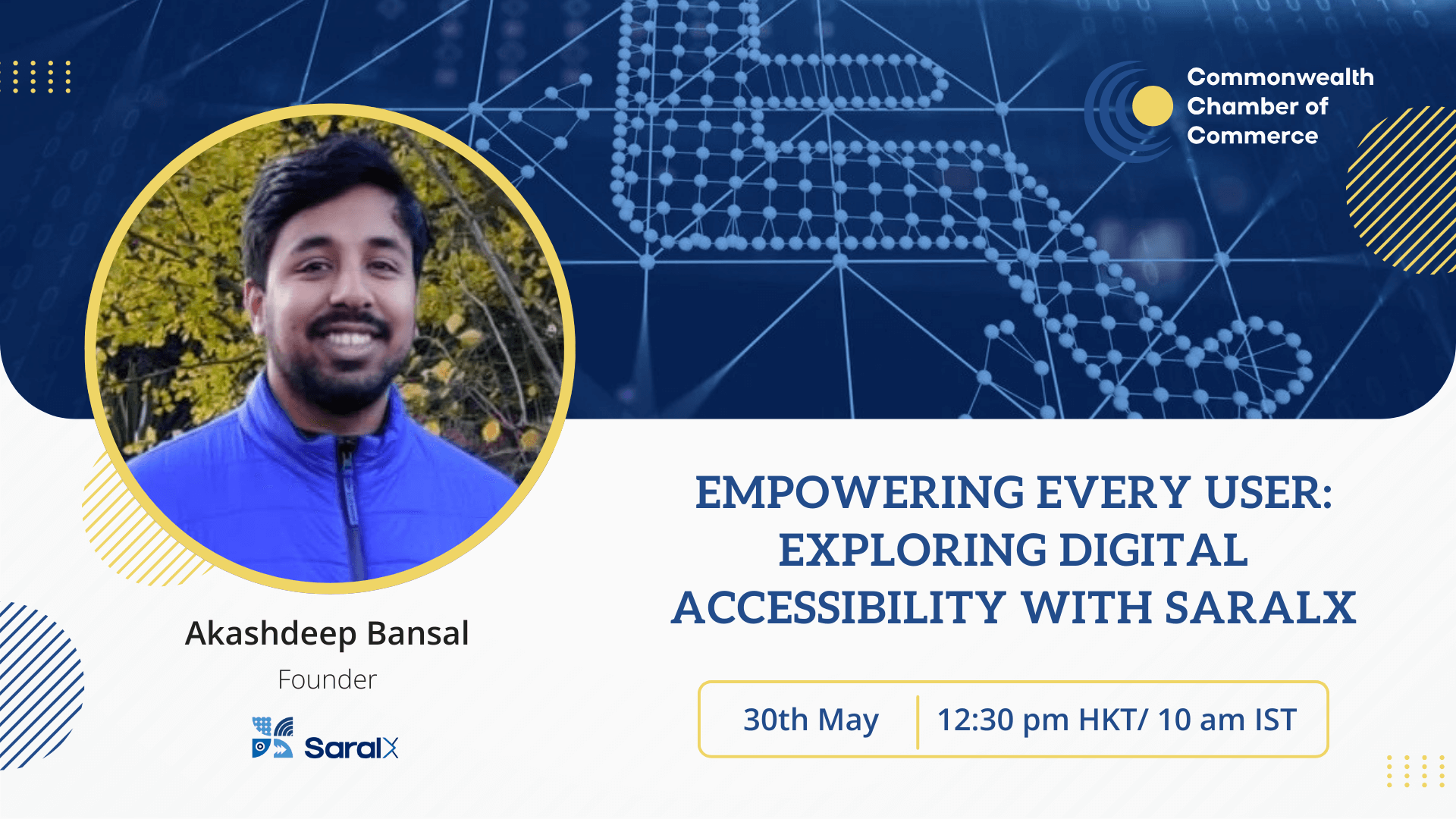

Empowering Every User: Exploring Digital Accessibility with SaralX | Webinar Recording

Watch a webinar by Akashdeep Bansal, founder of SaralX, hosted by the Commonwealth Chamber of Commerce, discussing digital accessibility, inclusive design, and the socioeconomic impact of disability inclusion.

Empowering Every User: Exploring Digital Accessibility with SaralX

In today’s digital age, accessibility is not merely at times obligation but a fundamental necessity for fostering an equitable and inclusive online environment. SaralX, an Indian startup, is spearheading efforts to dismantle such barriers and empower organizations to embrace the principles of inclusive design. This ensures that their digital assets are accessible to individuals with disabilities.