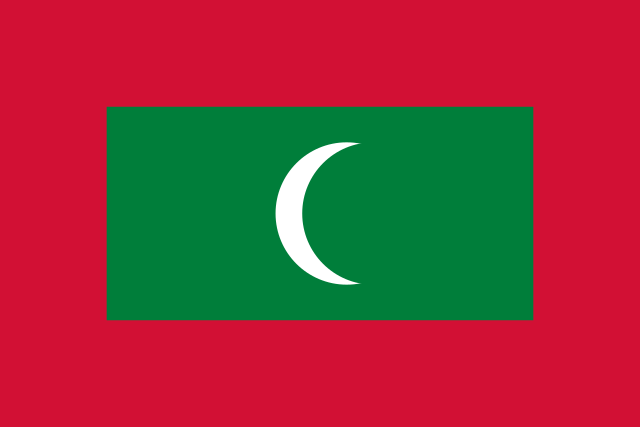

Maldives

Capital City: Male

Population: 606,800 (2022)

Land Area: 298 sqkm

Official Languages: Dhivehi (Maldivian)

Time Zone: GMT+5hr

Currency: Rufiyaa (MVR)

GDP: 4.89 billion USD (2021 est.)

Main industries: Tourism

Principal exports: Fish fillets, frozen fish, fresh fish, processed fish

The Maldives is a cluster of coral islands and sandbanks located in the Indian Ocean. It consists of a chain of 1192 islands in total, but only 200 are inhabited. The Indian mainland lies to its north, while Sri Lank is to its northeast. Temperatures in the Maldives are above average, with an average rainfall of 2,130mm per year, mainly due to southwest monsoons.

The islands of the Maldives originate from the crowns of a submerged ancient volcanic mountain. They are grouped into two chains of 26 atolls, with the capital island of Male located in the middle of the eastern chain. None of the islands rises more than 1.8 m above sea level. The Maldives is home to 5% of the world’s reefs. The reefs host over 1,000 species of fish, including large pelagic fishes like manta rays and whale sharks. The Maldives is, therefore, renowned for its stunning beaches, pristine turquoise waters, and unique underwater marine life.

Demographic

The population of the nation was recorded at 606,800 as of 2022. Over 90% of the population are Maldivians of Sri Lankan or Indian descent. Dhivehi is the official language in the Maldives. However, the need to promote higher education shifted the medium of instruction from Dhivehi to English. Arabic, Hindi, and English are spoken in Maldives. The state religion is Islam, thereby the majority of residents are Muslim.

Under 40% of Maldivian citizens live in urban areas either in or near the country’s capital, Male. The remainder of the population lives rurally on small islands in scattered atolls. Most of these inhabited islands are home to no more than 1,000 inhabitants.

History

The earliest traces of human activity in the Maldives dated back over 2,600 years ago, presumably by Sri Lankan and Indian people. Located on the maritime trading route of Egyptian, Mesopotamian, and Indus Valley civilisations, the Maldives became a strategic trading hub. An influx of Arab traders hugely influenced the culture of the Maldives. In 1153, the king converted from Buddhism to Islam and adopted the Muslim title of “sultan”.

The Portuguese occupied the island of Male in 1558 but were expelled by a guerrilla revolt after only 15 years. The Dutch established control over the sultanate that governed the islands according to traditional customs in the 17th century. In 1796, the islands became a British protectorate as the British seized Ceylon from the Dutch. This colonial status was later formalised in 1887 when the sultan accepted British influence over diplomatic relations and defense. Notably, the island of Male has remained free from foreign influence, as the colonial powers were reluctant to administer local matters directly.

Under British colonial rule, the succession of sultans was hereditary until 1932. The first constitution was proclaimed so that the sultans become elected, limiting the monarch’s absolute power. In 1953, the Maldives officially became a republic as the sultanate was suspended. The first elected president, Muhammad Amin Didi, introduced extensive reforms, including nationalisation of the fish export industry, reform of the education system, and promotion of women’s rights. However, conservatives were discontent with his reforms and overthrew his government during a riot over food shortage. The sultanate was restored in 1954.

Despite Maldivian independence, the British military presence persisted until 1965. In 1956, the sultan permitted Britain to re-establish a military base on the island of Gan in the southern Maldives. This is driven by the need for economic development, as the British pay a significant sum for the lease. As a result of the 1959 secession movement, the United Suvadivan Republic of 20,000 inhabitants in the south was formed. However, the republic was short-lived as the sultanate based in Male eliminated it by force in 1962. On 26 July 1965, the Maldives finally achieved independence from Britain, albeit allowing British use of the Gan and Hitaddu military facilities.

In November 1968, a new Republic was inaugurated in the Maldives after a national referendum to abolish the sultanate. The former prime minister under the sultanate, Ibrahim Nasir, was elected president. On 29 March 1976, the last British troops left the Maldives. This day is celebrated as the Maldives Independence Day. Maumoon Abdul Gayoom, leader of the Dhivehi Rayyithunge Party (DRP), became the longest-serving president of the Maldives, serving 30 years from 1978 to 2008. In 1982, the Maldives became a member of the Commonwealth of Nations.

In response to pro-democracy protests, a referendum was held in 2007 to determine the political system of the Maldives. The conventional presidential system defeated the reformists’ parliamentary system. Nonetheless, in 2008, a new constitution was adopted to impose checks and balances on the government. The first multi-candidate presidential election was held, which removed Gayoom from office.

Key Dates

1153 – Islam replaces Buddhism as the state religion

1796 – British protectorate established

1932 – Constitution proclaimed; Sultans becomes elected, not hereditary

1953 – Republic established

1954 – Sultanate restored

1965 – Maldives gains full political independence from the British on 26 July

1968 – Republic reinstated and the sultanate abolished after referendum

1982 – Maldives rejoins the Commonwealth

2007 – A referendum determines that the presidential system remains

2008 – New constitution adopted to allow multi-party presidential elections

Legal System and Government

The Maldives is a presidential multi-party republic wherein the president is the head of state and government. Every five years, universal suffrage is held to elect the president and the vice president directly, who can only serve a maximum of two terms. The cabinet is appointed by the president to assist him/her. The legislature consists of one council only, the People’s Majlis. Members are elected every five years from the administrative regions, which comprise of Male and 20 atoll groups. Despite having a democratic institution, only Muslims can become citizens and thus have a right to vote.

The Maldivian judiciary principally follows Islamic law, to which civil law is subordinate. All judges must also be Muslim. The High Court in the capital island serves as a court of appeal and a court of first instance on certain cases. Lower courts in Male are divided into specific areas such as theft and family law. However, the President may affirm or overturn High Court judgments through appointing a five-member council. On the other islands, an all-purpose court adjudicate all cases.

Economy

The Maldives is an upper-middle income country which ranks 2nd in human development in South Asia, notably outperforming its regional counterparts. The Maldives is the 3rd most reliant country on tourism in the world. It is also the 14th largest processed fish exporter in South Asia, with a much smaller geographical spread than other major exporters.

From 1996 to 2019, Maldives experienced an average annual GDP growth rate of 5.7%, before plunging to -33.5% in 2020. Despite a significant GDP growth of 41.7% in 2021, the actual GDP value has not yet returned to pre-COVID values of over US$5.60 billion. This is largely due to the Maldives’ heavy reliance on tourism and imports, which make it vulnerable to macroeconomic and external shocks. Prior to the pandemic, tourism and related services attributed a whopping 40% of the nation’s GDP and employed one-third of the labour force. To mitigate effects during recovery, the government has made efforts to reduce public debts and build resilience against future economic downturns. Such efforts have met some success; other industries such as fishing, shipping and boatbuilding are becoming more developed.

Maldives has also developed its agricultural sector with a vast array of crops cultivated including cereals, vegetables, fruits and tubers though coconuts are the most notable product due to their importance for trade and local diet. The sector remains to be developed further, as it currently only contributes 5.6% of GDP and employs 8% of the workforce. Export trade became another main pillar of the economy, as export volume equals to 118% of its GDP. The industrial sector of Maldives revolves around garment production, handicrafts and boat building, contributing 18% of GDP and employing one-fifth of the labour force.

Trade

The GDP in 2021 was US$4.89 billion. Current data on 2020 statistics show that the Maldives gained US$214 million via exports for the FY 2020-2021. The main export commodities were fish and crustaceans, molluscs and other aquatic invertebrates (71.8%) with notable other exports being preparations of meat, of fish or of crustaceans (21.4%) and iron and steel (3.5%). The main destinations of exports were Thailand (46.3%), Germany (11.5%), and the UK (6.9%). Imports amounted to US$1.38 billion mainly for mineral fuels, mineral oils and products of their distillation (17.8%), machinery, mechanical appliances, nuclear reactors and boilers (10.5%), electrical machinery and electronics (8.6%) and salt, sulphur, earths and stone (3.3%). These products were largely supplied by China (13.3%), Oman (13.1%), the UAE (12.6%), and India (12.2%).

The Maldives has entered into the South Asian Free Trade Agreement (SAFTA) and the South Asia Preferential Trade Arrangement (SAPTA). It also has preferential trade arrangements with Commonwealth member states Australia and New Zealand.

Investment Opportunities

The Maldives maintains a stable and transparent system of governance, is politically stable and boasts a liberal trade environment and dynamic private sector. With a robust legal framework for investments including the right to fully-foreign ownership of projects, long term contractual agreements and long term lease of land, freedom to use foreign workers and no restrictions on foreign exchange and repatriations of earnings and profits, the South Asian nation is a very favourable hotspot for FDI and joint venture projects. Maldives has a unified business registration service through its official investment agency, Invest Maldives, which also offers a Public Private Partnership Programme and investment programmes for foreign portfolio investors. Obtaining business and/or corporate visas has been made notably more efficient and convenient by the government of Maldives.

With its tropical climate, beautiful beaches and lush greenery, the Maldives is a popular tourist destination due to which there is plentiful investment opportunities in the growing demand for luxury resorts, guesthouses, yacht marinas. Eco-tourism is a particular focus as the nation’s biosphere reserves and protected areas of the Maldives offer great potential for foreign investments; research studies and projects are also another area of investment that can be explored. Interest in Maldivian real estate has been on the rise in the past decade meaning potential for foreign investors not only in the luxury accommodation industry but also in mixed housing projects, social housing and urban regional development.

The Maldives has a rich fishing industry, which also happens to amongst the greenest in the world due to which their exports carry a special premium. The government of Maldives is encouraging expansion to other international markets, especially for exports of skipjack and yellowfin tuna; foreign investors are welcome to establish these trade links and also invest in the existing fish processing industry; research and development into mariculture is also a lucrative area for foreign investment. Other areas of interest for foreign investors include ICT, banking and finance, transport and healthcare.

The Maldives offers several attractive incentives for foreign investors including tax holidays of up to 8 years, depending on the nature and size of the investment. This includes exemptions from corporate income tax, import duty, and goods and services tax. The Maldives has double taxation avoidance agreements with several countries, including India, Sri Lanka, and Malaysia, which helps to reduce the tax burden for foreign investors. Furthermore, foreign investors may be eligible for tax credits based on their investment, including credits for research and development, capital expenditures, and employment creation. They can also avail duty-free imports of capital goods, raw materials, and other inputs required for their business operations.