News & Events

Stay up to date on all our exciting new events and view past webinars and podcasts with instant playback.

India’s women make history, outclass South Africa to claim first ODI World Cup crown

India’s women’s cricket team made history on November 2, 2025, by clinching their maiden ICC Women’s ODI World Cup with a commanding 52-run victory over South Africa at Navi Mumbai’s Dr. DY Patil Stadium. India posted a strong total of 298/7, featuring a record-breaking 87 from Shafali Verma and a vital 58* from Deepti Sharma. Smriti Mandhana also contributed 45 runs and ended the tournament as the highest run-scorer in a single Women’s World Cup edition with 434 runs.

South Africa fought valiantly, with Laura Wolvaardt scoring 101, but Deepti Sharma’s brilliant bowling haul of 5/39 and Shafali’s crucial 2 wickets ended their chase at 246 all out. This victory made India the fourth nation to win the Women’s ODI World Cup, joining Australia, England, and New Zealand.

Read the original article here: https://www.newindianexpress.com/sport/cricket/2025/Nov/02/indias-women-make-history-outclass-south-africa-to-claim-first-odi-world-cup-crown

Commonwealth ministers commit to unlocking finance amid economic uncertainty

Commonwealth Finance Ministers gathered recently to address mounting global economic challenges, including trade tensions, inflation, debt issues, and geopolitical divisions.

The annual Commonwealth Finance Ministers Meeting (CFMM), chaired by Malta’s Finance Minister Clyde Caruana, took place alongside the IMF and World Bank Group meetings. The forum served as a platform for member countries to share experiences and develop common strategies for economic resilience.

Commonwealth Secretary-General Shirley Botchwey emphasised the unprecedented challenges facing the global economy, noting particular concerns for small states and least developed countries. She highlighted member countries’ innovative approaches, including blue bonds for ocean conservation and the Commonwealth Meridian debt management system, now operational in 41 nations.

The meeting focused on building a more inclusive global financial architecture that considers both income levels and vulnerability to economic shocks. Ministers discussed ways to enable sustainable investment in development and climate resilience while avoiding unsustainable debt cycles.

The CFMM continues to serve as a vital forum where developed and developing Commonwealth nations can collaborate on shared economic priorities and strengthen their collective voice in international financial discussions.

Read the original article here: https://thecommonwealth.org/news/commonwealth-ministers-commit-unlocking-finance-amid-economic-uncertainty

Uganda launches inaugural tourism roadshow in Mauritius to promote gorilla trekking and adventure tourism

Uganda took an exciting step to enhance tourism ties with Mauritius by launching its first-ever tourism roadshow in Port Louis. The event, titled “From Paradise to The Pearl,” aims to attract affluent Mauritian tourists by showcasing Uganda’s unique travel experiences, including its rich natural biodiversity and world-renowned gorilla trekking.

Organised by the Uganda High Commission in Dar es Salaam as part of Uganda’s Economic and Commercial Diplomacy program, the two-day roadshow was held at the Hennessy Park Hotel. It sought to position Uganda as a premier leisure destination beyond Mauritius’s traditional luxury beach market by promoting Uganda’s safaris, cultural tourism, and adventure activities.

The roadshow featured immersive virtual reality experiences of iconic attractions such as Murchison Falls and Bwindi Impenetrable National Park, allowing attendees to virtually explore Uganda’s landscapes and wildlife. Guests also enjoyed Ugandan coffee and local delicacies like the famous “rolex,” enhancing cultural engagement.

Read the original article here: https://www.travelandtourworld.com/news/article/uganda-launches-inaugural-tourism-roadshow-in-mauritius-to-promote-gorilla-trekking-and-adventure-tourism/

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

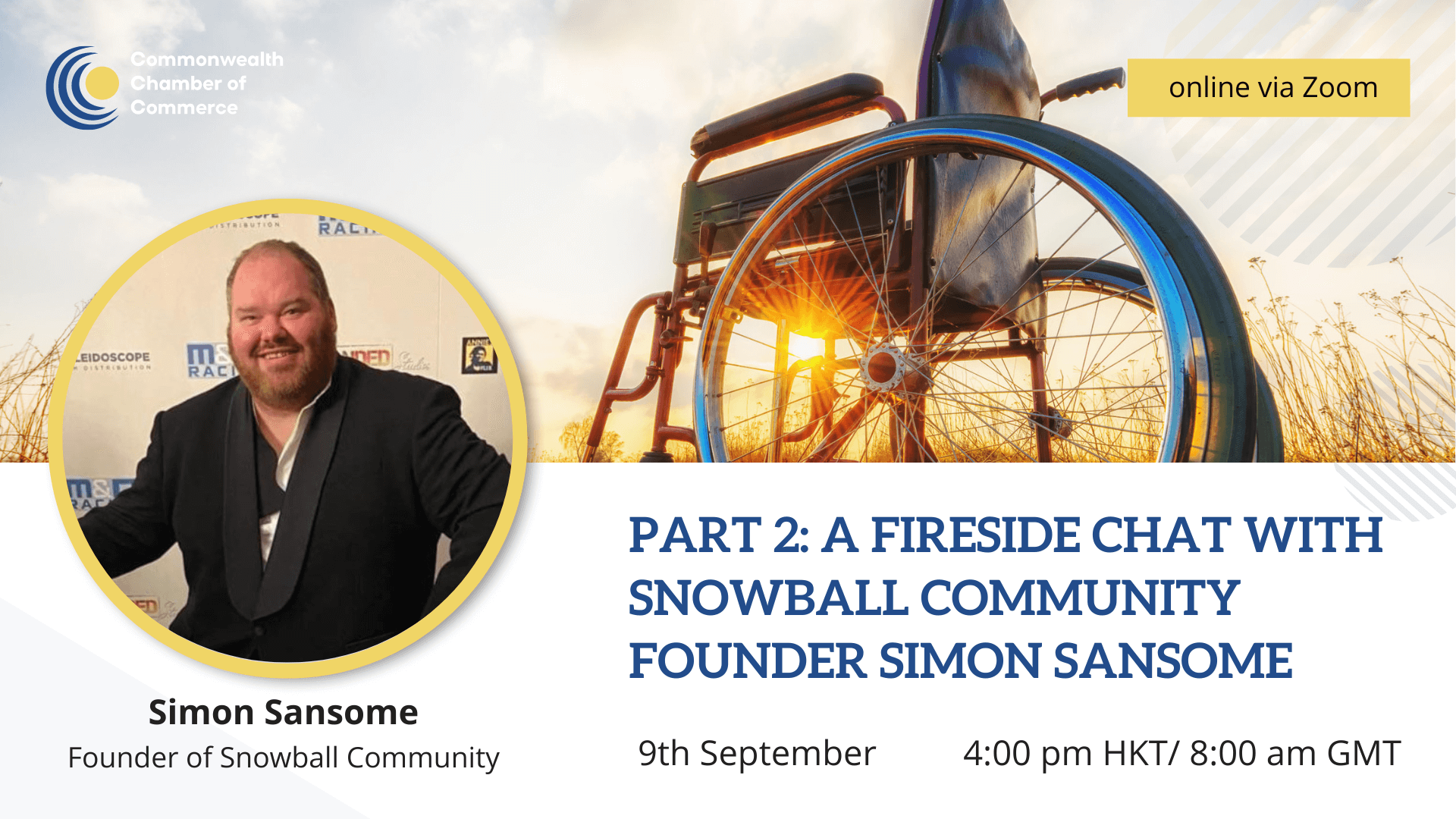

Part 2: A Fireside Chat with Snowball Community Founder Simon Sansome | Webinar Recording

Explore the key issues of accessibility and inclusion faced by the estimated 1.3 billion people with disabilities worldwide. This past webinar, hosted by Julia Charlton, highlighted innovative solutions like the Snowball Community app.

Part 2: A Fireside Chat with Snowball Community Founder Simon Sansome

Join us for an insightful webinar as we explore the power of accessibility and inclusion with Simon Sansome, founder of the Snowball Community app.

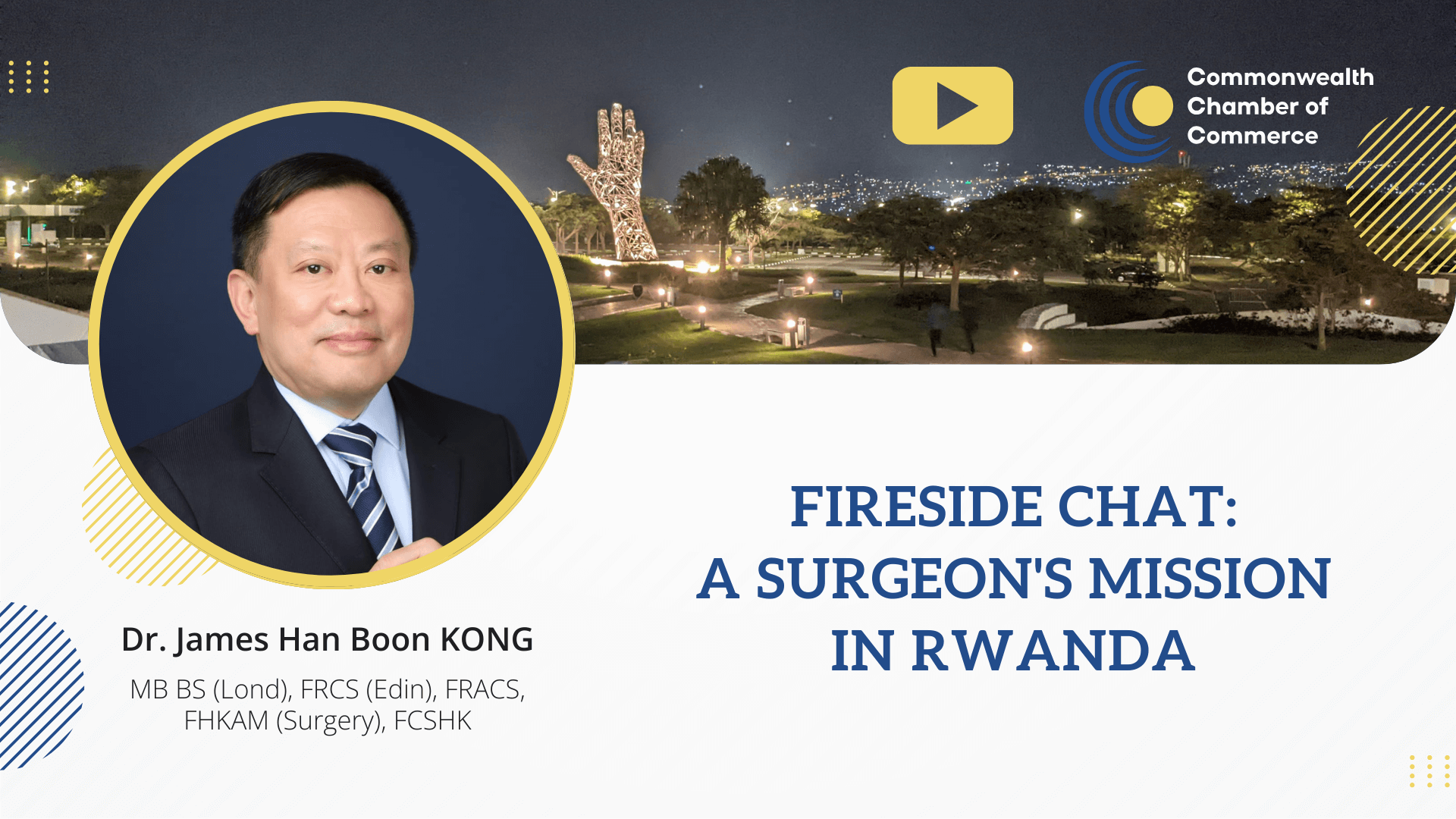

Fireside Chat: A Surgeon’s Mission in Rwanda | Webinar Recording

The Commonwealth Chamber of Commerce recently hosted a special fireside chat featuring Dr. James Han Boon KONG, an esteemed surgeon with over four decades of experience.