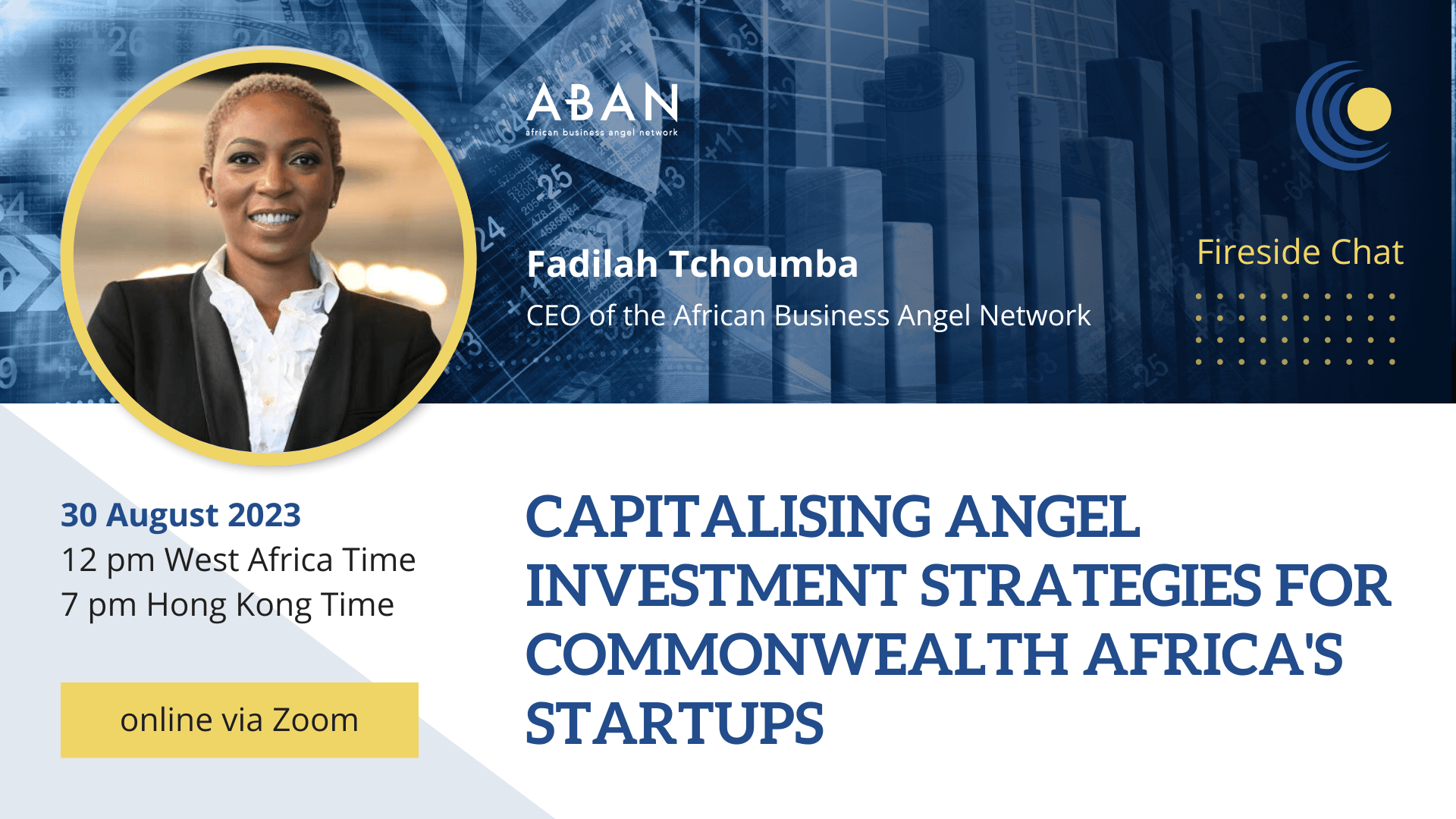

The Commonwealth Chamber of Commerce is delighted to present to you an all new fireside chat with the African Business Angel Network (ABAN) on the role of angel investment networks in transforming the entrepreneurial ecosystem of Africa.

This event will take place online via Zoom on 30 August 2023 at 12 pm West Africa Time/ 7 pm Hong Kong Time.

About the Event

The continent of Africa changed the discourse on disruptive startup ecosystems globally in 2015 when investment into the continent’s ecosystem increased seven-fold from US$26.9 million to US$185.7 million largely due to the popularity of 125 tech startups focussing on FinTech innovations. The momentum continues to build relatively undeterred and today, the continent’s ecosystem boasts over 665 startups that have amassed US$6.5 billion dollars thus far, with US$3.33 billion received in 2022 alone. Even during the peak of the global pandemic in 2021, the ecosystem amassed US$2.2 billion (an increase of 206.3% compared to 2020), minted 3 unicorns and saw some popular exits take place, including Stripe’s acquisition of Nigeria’s PayStack and WorldRemit’s acquisition of Kenya’s Sendwave.

Tech startups make the bulk of these investments and lead the continent’s performance in innovation and cross border deals, largely via the FinTech, EduTech, AgriTech and HealthTech industries. FinTech has emerged to be frontrunner amongst there industries with 6 of the 7 African unicorns thus far being FinTech companies. Aside from the immense and continuous annual growth in the past 8 years, the African ecosystem is boosting investor confidence as more and more African countries prioritise the development of their national ecosystems. While Nigeria, Egypt, Kenya and South Africa remain the top four leaders of the ecosystem, 2022 saw their proportion decreased by 12%, paving the way for emerging ecosystems in countries like Ghana, Tunisia and Morocco.

With more African startups gaining access to funding, the ecosystem is predicted become a global contender by the end of the decade. Achievements notwithstanding, a significant gap persists for nascent startups; in 2022, the ecosystem reported the highest number of disclosed investors in the history of the ecosystem, around 987 active investors as compared to 771 disclosed in the year prior. Despite the greater availability of capital, budding entrepreneurs have consistently flagged concerns of lack of capital, claiming that majority of the funds are dedicated to more established ventures as well as lack of mentorship and guidance on securing more funding. On the flip side, investors bemoan the absence of a viable investment pipeline; foreign investors also struggle with regulatory issues and find it challenging to invest without an intermediary.

Angel investment in Africa emerges as a pivotal solution, addressing the gap between the initial idea stage and the subsequent growth phase of ventures, while also aiding enterprises in realizing their goals as generators of employment and inventive remedies for local societal issues. The surge in angel investor funding for African startups parallels the advancement of startup ecosystems, considerably augmenting the pool of potential investment prospects. Encouraged by early achievements, including the rise of prosperous Fintech startups, global angel investors are displaying escalating enthusiasm for participation in this burgeoning landscape.

Join the Commonwealth Chamber of Commerce as we sit in conversation with Fadilah Tchoumba, CEO of the African Business Angel Network (ABAN), a pan African non-profit association founded to support the development of early-stage investor networks, as we discuss the latest trends and developments in the angel investment networks in Africa and how the Commonwealth can galvanise the synergies between Commonwealth African startup ecosystems and angel investor networks to bridge the funding gap to help unleash Africa’s full entrepreneurial potential.

About the Speaker

Fadilah Tchoumba

CEO, African Business Angel Network

Fadilah Tchoumba is CEO of ABAN and the fund manager for Catalytic Africa, a matching fund for early stage startups in Africa. Before joining ABAN, Fadilah managed investment portfolios on behalf of institutional investors with interests in trade on the continent. She has worked as the Director of Business and Innovation across Africa for the Royal Commonwealth Society, one of the primary organs of the Commonwealth, where she steered and led the creation of innovative projects that aligned to the values of the Commonwealth. Fadilah is a founding member and senior analyst at Amzill, a data collection and analysis firm and she is also on the advisory board of ENRICH in Africa.

Fadilah has brought depth and knowledge to analysis of industry specific trends across the African continent. Her contribution ranges from understanding the socio-cultural and economic dynamics of African startups and SMEs to sharia-compliant financial inclusion. She has been instrumental in the development of tech-driven early stage matching fund solutions for innovative startups in African market which has made her a leader in this niche of alternative asset classes. She is passionate about innovation and sustainability in Africa’s entrepreneurial ecosystem and continues to champion angel investing, cross-border co- investments, angels’ capacity building, and policy advocacy as key catalysts for the success of early-stage investing in Africa.

Fadilah holds a BA in Economics and Philosophy from Connecticut College, a diploma in International Commerce and Trade from Georgetown University and a Master’s degree from the London School of Economics.

Moderator

Julia Charlton

Chairman, Commonwealth Chamber of Commerce

Julia is the founding and managing partner of Charltons, an award winning Hong Kong corporate finance Hong Kong law firm. Julia is admitted as a solicitor in Hong Kong, England and Wales and the BVI. She practises in the field of corporate finance, including M&A, private equity, securities, virtual assets and funds.

Julia is a member of the Commonwealth Enterprise & Investment Council (CWEIC)’s Global Advisory Council. She is also a member of several Hong Kong boards and committees, most notably The Takeovers and Mergers Panel and the Takeovers Appeals Committee of the Hong Kong Securities and Futures Commission and the Listing Review Committee of the Hong Kong Stock Exchange. Julia is also a Senior Fellow of the Hong Kong Securities and Investment Institute.